Curious about how steel-free tire scrap—often overlooked as “low-value waste”—breaks through traditional recycling limitations, realizes precise resource utilization, and becomes a new profit growth point for recycling enterprises? This guide explores its unique technical path, application scenarios, equipment configuration, and investment logic, revealing the hidden value of this specialized track.

I. Why is Steel-Free Tire Scrap Recycling a “Blue Ocean” Track?

Steel-free tires (industrial all-rubber tires, forklift solid tires, etc.) generate scrap with over 95% rubber purity, lacking steel wire. Its core advantages make it a high-potential track:

- Low Processing Cost: Eliminates complex steel wire/fiber separation, cutting costs by 30-40% vs. ordinary tire recycling.

- High-Value Orientation: Recycled products meet high-end standards for medical, food, and precision industrial use—unattainable for steel-containing recycled rubber.

- Policy Support: EU/US offer 50-100 USD/ton subsidies and tax exemptions for specialized industrial rubber recycling.

- Ample Raw Materials: Annual scrap generation grows 15-20% with logistics/manufacturing development, ensuring stable supply.

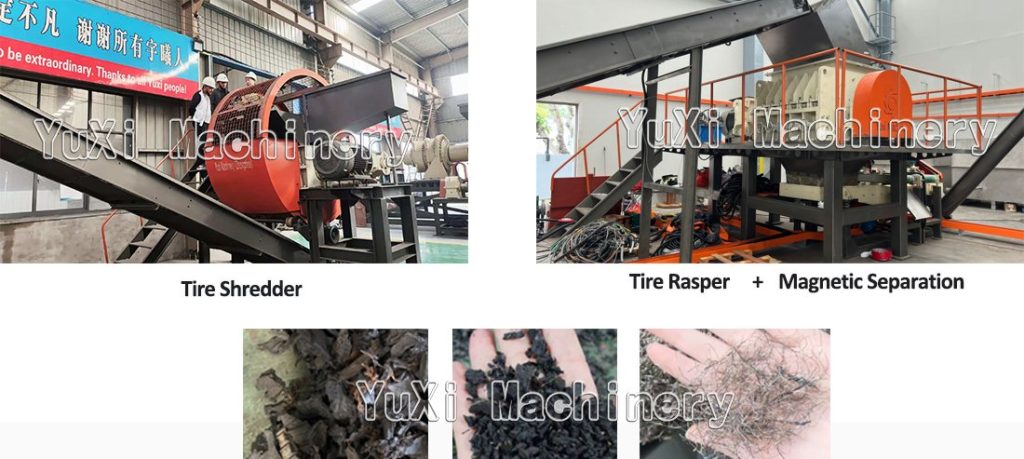

II. Core Technical Process of Steel-Free Tire Scrap Recycling

Focused on “retaining rubber performance” and “customization”, the process includes 5 streamlined links:

- Classification & Pretreatment

Sort scrap by rubber type (natural/synthetic), hardness, and use scenario. Clean with high-pressure water, cut into 30-50 cm blocks for crushing. - Low-Temperature Crushing

Use a 75-110 HP low-temperature crusher (circulating water cooling, 20-30℃) to crush scrap into 5-10 mm particles, avoiding high-temperature aging. - Fiber Separation (If Needed)

High-efficiency air separators remove residual fiber (≤0.5% content) for building material recycling, improving resource utilization. - Fine Grinding & Modification

Two-stage grinding produces 80-150 mesh ultra-fine rubber powder (temperature ≤60℃ to retain 90% raw rubber performance). Optional modification (desulfurization, activation, functional additives) meets high-end demands (e.g., US UL94 V-0 flame-retardant standard). - Quality Inspection & Packaging

Test for particle size, tensile strength, and purity (compliant with EU EN 15340/US ASTM D5603). Package in 25 kg/bags or ton bags, store in temperature-controlled warehouses.

III. Key Equipment Selection Criteria

- Low-Temperature Crusher: 90 HP IE3 motor, AISI 420 cutters, adjustable 5-10 mm screen, 1.5-2.5 tons/hour efficiency.

- Two-Stage Grinder: Tungsten steel discs (≥1500 hours life), 40-150 mesh range, ≤5μm dust filtration, intelligent temperature control.

- Air Separator: 5000-8000 m³/h air volume, ≥99% separation efficiency, cyclone structure.

- Testing Equipment: Laser particle size analyzer, tensile tester, ash/moisture analyzers for full-process quality control.

IV. Application Scenarios & Profit Model

Core Applications

- Medical/Food: High-purity rubber for seals, food-grade conveyor belts.

- Industrial Manufacturing: Ultra-fine powder for O-rings, gaskets, rubber rollers.

- Automotive: Desulfurized rubber for interior parts, shock absorbers.

- Building Materials: Modified asphalt for roads, rubber concrete for sound insulation.

Profit Model

- Rubber Powder Sales: 800-1200 USD/ton (ordinary), 1500-2000 USD/ton (ultra-fine); 50-100% profit margin.

- Custom Modification: 30-50% premium for functional products (flame-retardant, conductive).

- Subsidies/Carbon Credits: 50-100 USD/ton subsidies + carbon credit trading.

- Disposal Services: 50-80 USD/ton for enterprise scrap disposal.

V. Investment & Revenue Analysis (2 Ton/Hour Line, EU/US Standards)

Initial Investment

- Equipment: 80,000-120,000 USD; Site/Infrastructure: 30,000-40,000 USD; Other Costs: 20,000-30,000 USD; Total: 130,000-190,000 USD.

Operating Costs (8hrs/day, 25days/month)

- Raw Materials: 200-300 USD/ton; Energy: 12,050-16,860 USD/month; Labor: 12,000-20,000 USD/month; Maintenance: 5,000-8,000 USD/month; Unit Cost: 744-1,125 USD/ton.

Revenue & Profit

- Monthly Revenue: 336,000-567,200 USD (powder + modification + subsidies + disposal).

- Monthly Profit: 269,690-387,200 USD; Payback Period: 4-6 months.

VI. Risk Prevention & Trends

- Risks: Control raw material quality, focus on high-end differentiation, cooperate with R&D-capable equipment suppliers.

- Trends: Intelligent production, industrial chain integration, high-value R&D for new energy/aerospace applications.

Steel-free tire scrap recycling relies on specialization and precision to turn low-value waste into high-quality resources. With low processing costs, high-value applications, and policy support, it’s a low-risk, high-return choice for enterprises to break through homogeneous competition. As high-end demand expands, it will become a key segment in the circular economy.